Talking about the energy transition is no longer a prospective exercise; it has become a concrete discussion about economic competitiveness, energy security, and geopolitical positioning. A topic that little more than a decade ago revolved mainly around academic reports and multilateral forums is now at the center of decisions by governments, companies, investors, and regulatory bodies.

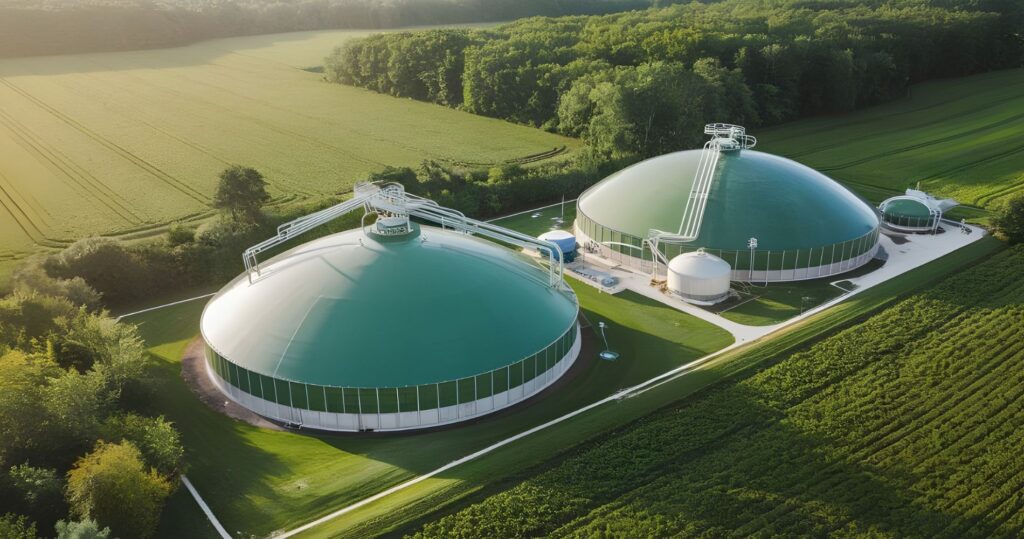

The IEA report highlights that global biogas and biomethane production volumes could rise by 22 percent by 2030 compared to 2025, reflecting a review of expectations and a more favorable scenario for investments in renewable energy. The analysis includes data that reveals variations in the speed of growth between regions, with emphasis on Europe, North America and developing markets in Asia and Latin America.

In a study presented in November 2025 during COP30 in Belém, the Ministry of Planning and Budget released a 219-page analysis quantifying the economic impacts of climate change in Brazil. The numbers reveal that climate action is not an isolated environmental issue, but a structural economic imperative: inaction could cost between R$10.3 trillion and R$17.1 trillion in GDP by 2050, while climate action would generate an additional R$6.7 trillion in wealth.

In December 2025, the Paris Agreement marked a decade as the cornerstone of global climate governance. Signed by 195 countries at COP21, the agreement established the commitment to limit the increase in average global temperature to well below 2 °C above pre-industrial levels, while pursuing efforts to cap warming at 1.5 °C. Ten years on, the question that arises is both direct and strategic: in practical terms, what are the impacts of these targets on the energy sector and on investment decisions?

As global leaders debate the direction of decarbonization, Brazil emerges as a key player in the energy revolution driven by the circular economy and biomethane. In the wake of COP30, held in Belém, the country intensifies its efforts to align sustainability, social inclusion and technological innovation. The November 2025 landscape establishes biomethane and eco-parks as […]

Brazil is experiencing one of the most decisive moments in its energy history. With an electricity mix already largely renewable—about 88% of generation coming from clean sources, according to data from the Energy Research Company (EPE)—the country now faces a new challenge: financing the sustainable expansion of its infrastructure, diversifying its energy matrix, and ensuring energy security amid the global transition to a low-carbon economy.