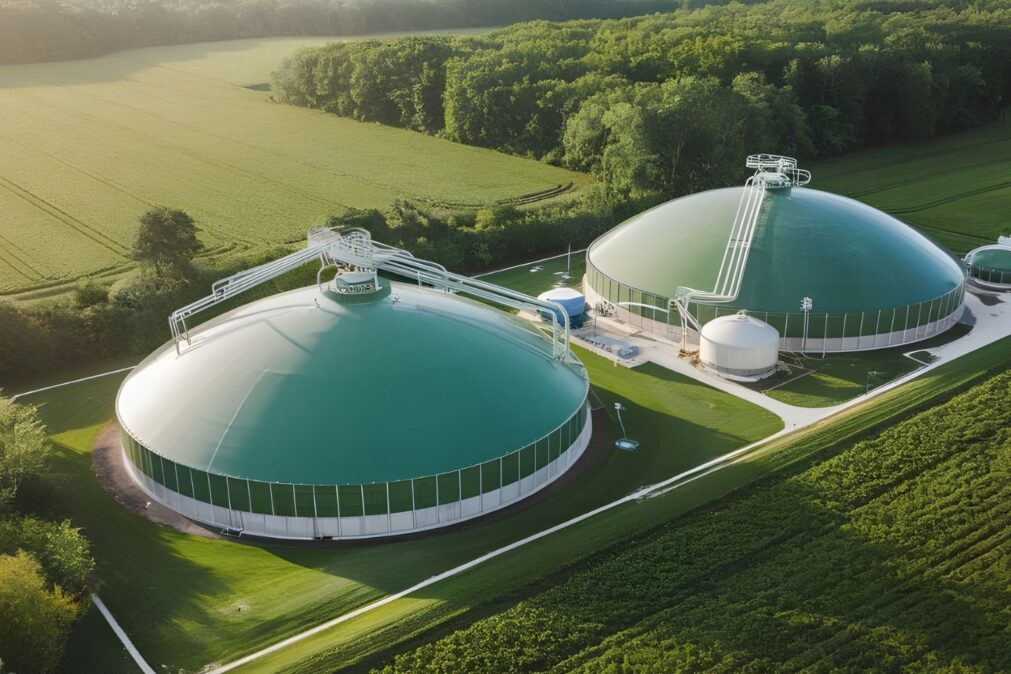

Decree 12,614/2025, which regulates the Future Fuels Law, created the National Natural Gas Decarbonization Program and established a biomethane mandate starting in 2026. Under the rule, natural gas producers and importers must meet annual emissions-reduction targets, linked either to injecting renewable gas into the network or to proving—through certificates—that part of their supply originates from biomethane.

The initial target set for 2026 is a 1% reduction in the emissions associated with the natural gas marketed in Brazil. Depending on the emissions factor used, that translates to roughly 1.1% to 1.4% of the physical volume being replaced by biomethane. The planned trajectory allows this percentage to rise gradually to around 10% by 2034, making biomethane a lasting component of Brazil’s gas mix over the next decade.

While the 1% level is seen as conservative by some market participants, the measure introduces— for the first time— a regulatory obligation to decarbonize natural gas in Brazil. Rather than relying solely on voluntary initiatives or sectoral programs, biomethane becomes part of a state policy, with defined targets, deadlines, and enforcement mechanisms.

What 1% means in decarbonization terms

From a climate perspective, the 1% contribution in 2026 is a starting point—more structural than transformative. In absolute terms, the volume of avoided emissions is still small compared with total greenhouse-gas emissions from the energy sector and the Brazilian economy as a whole.

Analyses published in specialized outlets such as Brasil Energia and in public-policy platforms describe two distinct effects of the mandate. The first is the direct effect: replacing a share of fossil gas with biomethane in uses such as thermal power generation, industrial processes, and other thermal applications—delivering a proportional reduction in fossil CO₂ emissions and in methane emissions across the supply chain. The second is the signaling effect: creating compulsory demand that reduces regulatory uncertainty, anchors long-term contracts, and unlocks financing for new biogas and biomethane plants.

In this context, international emissions-accounting standards such as those of the GHG Protocol become important to ensure that biomethane-related emissions reductions are recorded transparently in corporate inventories—especially in scopes tied to energy consumption. If the target pathway approaches 10% by 2034, projections suggest the substitution of a meaningful share of natural gas in segments that currently have few competitive near-term technology alternatives.

CGOB and the dispute over “who pays the bill”

The mandate’s design allows compliance through two primary routes: physical blending of biomethane into the natural gas delivered to consumers, or proof—via Biomethane Guarantees of Origin Certificates (CGOBs)—that a given volume of gas has a renewable origin. The CGOB serves as a traceability and valuation instrument for biomethane’s environmental attributes, enabling decarbonization to be accounted for even when renewable and fossil gas circulate through the same network.

ANP Public Hearing 13/2025, held as part of the regulation of the Future Fuel program, surfaced one of the policy’s key tensions: defining who bears the cost of decarbonization. Submissions point to diverging views among production, trading, distribution, and large consumers on how to allocate the financial burden of meeting the targets—especially in the early years, when the market is still nascent.

An article published on Biogás & Energia captures the debate by asking, “who will pay the bill for decarbonization,” underscoring the CGOB’s central role in price formation and in cost allocation across the value chain. Analysts note that the final cost-sharing model and the methodology for setting agent-specific targets will be decisive for the pace of biomethane expansion. A design that concentrates the burden on a few links in the chain may trigger resistance and litigation, while a model that combines predictability, gradualism, and transparency is more likely to support supply growth and certificate-market liquidity.

São Paulo as a regional scale laboratory

In 2026, the State of São Paulo entered the biomethane market in a leading position, with roughly 500 thousand cubic meters per day already in operation and projections of surpassing 700 thousand cubic meters per day by year-end. This progress is detailed in a statement from Agência São Paulo, which links renewable gas growth to waste policies, agroenergy, and state-level climate targets.

A study cited by the São Paulo Secretariat for the Environment, Infrastructure and Logistics indicates that the state’s long-term potential could reach 36 million cubic meters of biomethane per day. That volume would be enough to fully replace São Paulo’s industrial natural gas consumption or up to 85% of the diesel currently used in the state’s transport sector—illustrating the scale of the opportunity in terms of both decarbonization and supply security.

In practice, São Paulo’s advance functions as a public-policy laboratory, integrating climate targets, gas regulation, and waste management. By channeling urban and agro-industrial waste into biogas and biomethane production, the state combines emissions reductions with circular economy benefits and mitigation of local impacts from landfills and effluents—creating a broader set of environmental and social gains.

Biomethane in logistics and on the farm

In transport, biomethane begins to emerge as a concrete alternative to diesel in 2026. Sector reporting points to its use on high-volume routes between Rio de Janeiro and São Paulo, with heavy-duty trucks using renewable gas as a partial substitute for fossil fuel. Adoption in truck fleets and urban buses is likely to grow along corridors with refueling infrastructure—especially where there is local biomethane production and related logistics advantages.

In rural areas, biomethane connects with the agenda of on-farm energy, manure management, and the modernization of agricultural machinery. Reports such as Panorama do Biogás no Brasil 2024, from Abiogás, show that farms with high volumes of organic waste can produce biogas and upgrade it to biomethane—reducing fuel costs, cutting methane emissions from diffuse sources, and generating additional revenue by selling surplus volumes into the grid.

This mix of applications reinforces biomethane’s role as a transition solution for hard-to-electrify sectors, such as long-haul heavy transport and high-heat industrial thermal processes. At the same time, it positions renewable gas as an intermediate step between fossil natural gas and more mature solutions such as full electrification or low-carbon hydrogen.

Biomethane through the investor lens

Biomethane is also starting to appear on the radar of investors aligned with sustainable investment indices and strategies, such as those tracked by FTSE Russell. The “2026 Sustainable Investment Trends” report suggests that assets linked to the energy transition, renewable gas infrastructure, and circular-economy solutions are gaining relevance in portfolios seeking to align financial returns with climate goals.

For institutional investors, biomethane offers a compelling combination of attributes: reductions in CO₂ and methane emissions, contributions to national and corporate targets, and the potential for additional revenue through certificates and carbon markets. At the same time, the credibility of emissions data and adherence to standards such as the GHG Protocol will be prerequisites for these assets to be fully recognized within more sophisticated ESG strategies.

A first test for regulated gas decarbonization

In 2026, biomethane’s impact on Brazil’s decarbonization will show up less in the absolute emissions numbers and more in the creation of a regulatory and market framework. The year marks the shift of the biogas and biomethane agenda from proposals and sector studies to a mandatory target regime—with defined instruments and regulatory monitoring by ANP.

Regional expansion—driven by states such as São Paulo and by logistics corridors in Brazil’s Southeast—shows that it is possible to combine supply security, waste management, and emissions reductions within a single public-policy vector. The challenge from 2026 onward will be to turn this first step into a consistent trajectory of higher targets, expanded supply, and integration with other climate, waste, and transport policies.

In this context, biomethane is likely to be watched as the first major test of Brazil’s ability to structure a regulated decarbonization mechanism for natural gas—featuring clear targets, robust traceability tools, and a growing share of projects anchored in the circular economy and low-carbon distributed generation.